France Alternative Lending Market: A Growing Opportunity for Business and Investment

Welcome to the world of alternative lending in France! In this article, we will delve into the thriving market of alternative lending and its potential for business growth and investment. With a forecasted annual growth rate of 17.4% and a projected market value of US$ 8.19 billion by 2027, the alternative lending industry in France presents a promising opportunity. Join me as we explore the size, trends, and key industry leaders in this dynamic market. Let’s dive in!

The Growing Alternative Lending Market in France

Explore the size and potential of the alternative lending market in France.

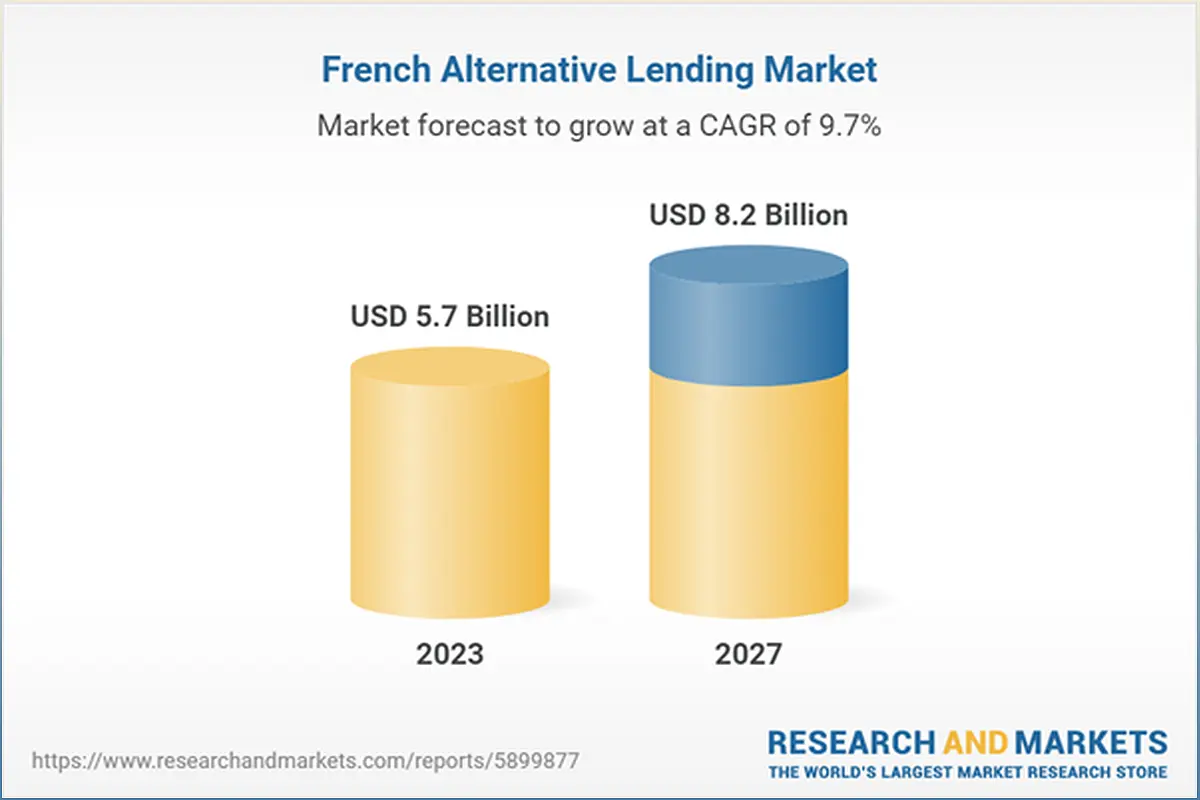

France’s alternative lending market is experiencing significant growth, with a forecasted annual growth rate of 17.4%. By 2023, it is projected to reach a market value of US$ 5.67 billion, and by 2027, it is expected to reach US$ 8.19 billion.

This presents a lucrative opportunity for businesses and investors looking to tap into the alternative lending industry. With a strong medium to long-term growth story, the adoption of alternative lending is expected to increase steadily over the forecast period.

Let’s delve into the comprehensive market intelligence, emerging trends, and key industry leaders in the alternative lending market in France.

Understanding Transaction Dynamics and Consumer Attitudes

Gain insights into transaction dynamics and consumer attitudes in the alternative lending market.

Transaction dynamics play a crucial role in the alternative lending market. Understanding the relationships between payment instruments and lending models is essential for businesses and investors.

In addition, analyzing consumer attitudes and behaviors, including the impact of age, income, and gender on financial choices, provides valuable insights for developing targeted marketing and lending strategies.

Let’s explore in-depth trend analyses for transaction value, average value, and transaction volume within the France alternative lending sector.

Segmentation Analysis and Future Growth Projections

Discover strategic segmentation analysis and future growth projections in the alternative lending market.

Strategic segmentation analysis based on financial models, payment methods, and end-users offers a comprehensive understanding of market segments in the alternative lending industry.

Furthermore, future growth projections classified by end-user, financial model, and payment instrument provide insights into areas with growth potential within various market segments.

Let’s examine the different loan types, including B2C Loans and B2B Loans, and gain valuable market insights.

The Impact of Consumer Attitudes and Behavior

Explore the influence of consumer attitudes and behavior on the alternative lending market.

Consumer attitudes and behavior play a significant role in shaping the alternative lending market. By analyzing the impact of age, income, and gender on financial choices, businesses and investors can develop effective marketing and lending strategies.

Let’s delve into the consumer attitude and behavior analysis, segmented by age, income, and gender, to gain insights into the preferences and motivations of potential borrowers.