Can China Tackle its Property Crisis Without Fueling Iron Ore Surge?

China is grappling with a challenging situation as it seeks to address its years-long property crisis while avoiding a surge in iron ore prices. The Chinese government is taking decisive steps to ease the impact of the real estate crunch, but it must also consider the consequences for the price of iron ore, a key source of commodity inflation. This article explores the dilemma facing China and how its actions could shape the market for iron ore.

China’s Property Crisis: A Delicate Balancing Act

Navigating the challenges of the property crisis and iron ore prices

China is currently facing a significant property crisis, and the government is under pressure to find a solution. However, addressing this crisis without causing a surge in iron ore prices presents a delicate balancing act.

The Chinese government’s actions to ease the impact of the real estate crunch have already had repercussions on the price of iron ore, a crucial commodity for the country. As a result, it must carefully navigate the challenges of stabilizing the property market while also preventing a surge in iron ore prices.

Tightening Supervision: China’s Response to Iron Ore Surge

The National Development and Reform Commission’s measures to control iron ore prices

Recognizing the surge in iron ore prices, China’s top economic planning body, the National Development and Reform Commission (NDRC), has taken steps to tighten supervision. The NDRC has sent staff to the exchange hosting futures trading to ensure tighter oversight and has cautioned against hype, manipulation, and illegal activities in the market.

In addition, the NDRC aims to strengthen oversight of iron ore held at ports to prevent hoarding and speculation. These measures are part of the government’s efforts to control the surge in iron ore prices and stabilize the market.

Impact on Market Dynamics: Iron Ore and Real Estate

The interplay between iron ore prices and the real estate sector

The market dynamics of iron ore and the real estate sector are closely intertwined. The success of the government’s stimulus measures to revive the real estate sector will not only determine the future of the property market but also have implications for iron ore prices.

While these measures may temporarily slow down the basis of price appreciation and cause pullbacks, they are unlikely to deliver a sustained change in the trend. Traders in China report a more bullish tilt in the market’s mood, despite the government’s scrutiny.

China’s Historical View on Iron Ore Rallies

China’s suspicion towards iron ore rallies and interventionist approach

China has long viewed iron ore rallies with suspicion and has become more interventionist in recent years to contain commodity prices. The government aims to diminish the market clout of global mining giants like BHP Group Ltd. and Rio Tinto Group, which it believes profit disproportionately from Chinese demand.

These historical perspectives and interventionist measures add complexity to the iron ore market and influence the government’s actions to address the property crisis without fueling further iron ore price surges.

Supply and Demand Factors: Iron Ore and Property Stimulus

The role of supply and demand in iron ore prices amid property stimulus

The next moves in the iron ore market depend not only on the impact of Beijing’s stimulus measures on iron ore supply but also on the government’s ability to rein in bullish sentiment as it revitalizes the real estate sector.

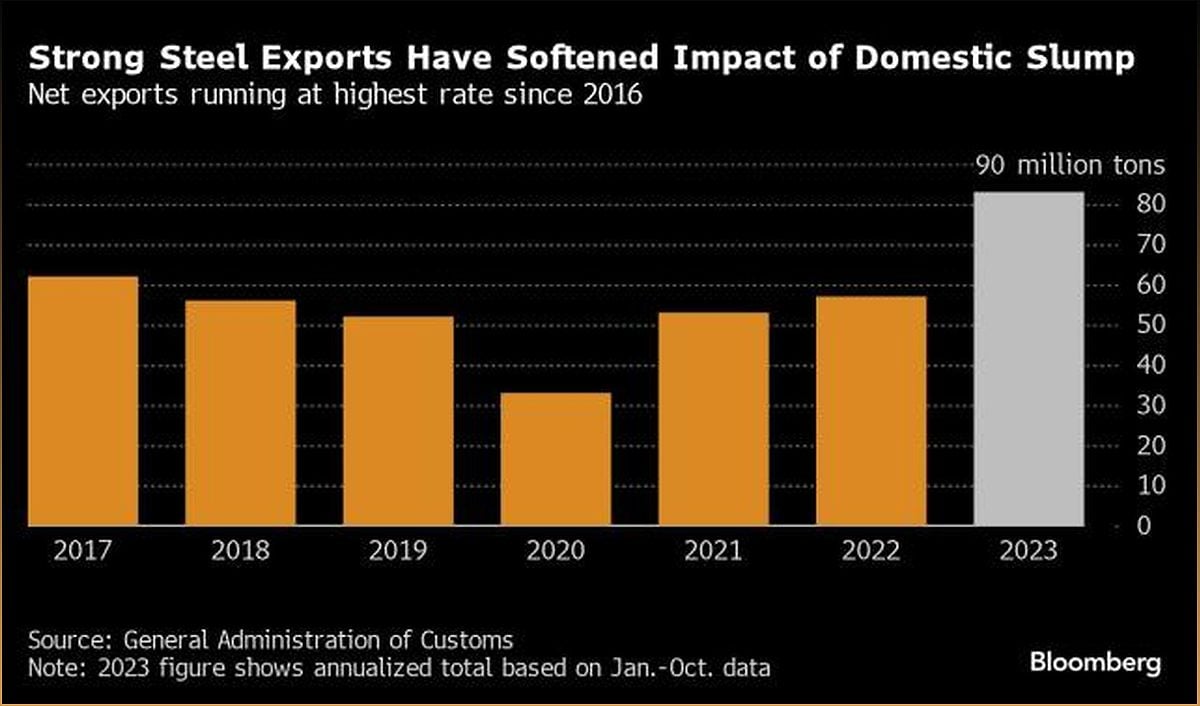

China’s steel production remains robust, and reduced availability of scrap, alongside rising steel exports, has contributed to the resilience of iron ore prices. However, the recent gains are largely based on the bet that Beijing’s property stimulus measures will stabilize demand and ensure a steady consumption of iron ore.

Outlook and Future Prospects: Iron Ore and Construction Steel

Predictions for iron ore prices and construction steel demand

Despite the current weak demand, analysts expect iron ore prices to remain strong in the near future. Citigroup Inc. predicts prices reaching $140 a ton soon, with construction steel demand stabilizing in 2024.

The turn in sentiment and the tightening supply chain indicate that iron ore prices may present buying opportunities, especially if there are temporary dips in prices. The outlook for construction steel demand is also positive, further supporting the optimism surrounding iron ore prices.