Is Vector Group’s Dividend Sustainable? A Closer Look at the Financials

Regular readers know that dividends are highly valued at Simply Wall St. In this article, we will delve into Vector Group’s upcoming dividend and assess its sustainability. By examining the company’s earnings, cash flow, and dividend growth, we can gain insights into the potential risks involved. Let’s take a closer look at Vector Group’s financials.

Understanding the Ex-Dividend Date

Learn about the significance of the ex-dividend date and its impact on dividend eligibility.

The ex-dividend date is an important milestone for investors to be aware of. It is the date on which a company determines the shareholders eligible to receive a dividend. In the case of Vector Group, the ex-dividend date is just three days away.

Investors should note that any purchase of Vector Group’s shares on or after the ex-dividend date, which falls on November 30th, will not entitle them to the upcoming dividend payment on December 15th.

Assessing Dividend Sustainability

Evaluate Vector Group’s dividend sustainability by analyzing its earnings, cash flow, and payout ratios.

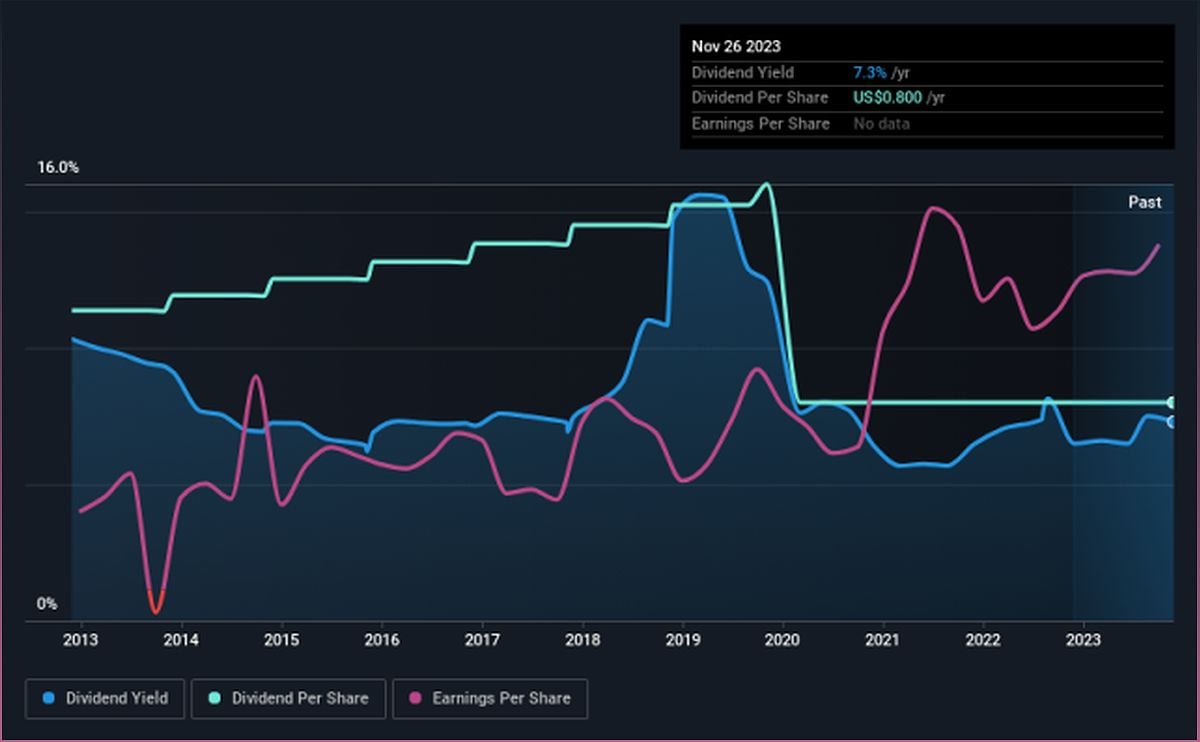

One key factor in determining the sustainability of a dividend is the company’s earnings. Vector Group paid out 73% of its earnings to investors last year, which is a normal payout level for most businesses.

Additionally, it’s important to assess the dividend coverage by cash flow. Vector Group paid out 69% of its free cash flow in the past year, which is within the average range for most companies.

By considering both earnings and cash flow, we can conclude that Vector Group’s dividend is covered by both profits and cash flow, indicating its sustainability.

Earnings and Dividend Growth

Explore Vector Group’s earnings and dividend growth trends to gauge its potential for future dividend increases.

Companies with consistently growing earnings per share often make the best dividend stocks. In the case of Vector Group, its earnings per share have been growing at a rate of 15% per year for the past five years.

Although Vector Group has seen a decline in its dividend over the past 10 years, it is noteworthy that earnings per share have been improving during the same period. This suggests a potential for future dividend increases.

Analyzing Risks and Conclusion

Identify potential risks and conclude on the sustainability of Vector Group’s dividend.

While Vector Group’s dividend shows positive characteristics such as growing earnings and coverage by profits and cash flow, there are still risks to consider. Investors should be cautious of the company’s high payout ratios, as a slowdown in earnings growth could limit future dividend increases.

In conclusion, while Vector Group offers an appealing dividend, it is important to carefully evaluate the risks involved. Investors should monitor the company’s financial performance and dividend policies to make informed decisions.