The Importance of Independent Directors in Ensuring Corporate Governance

In the latest amendment to the corporate governance code in Bangladesh, listed enterprises are now required to appoint at least two independent directors. While some company owners view this as unwanted intervention, the amendment aims to ensure corporate governance and accuracy in financial reporting. Independent directors can help identify malpractice and protect shareholders’ interests. Discover the significance of independent directors in maintaining transparency and accountability within businesses.

The Need for Independent Directors

The latest amendment to the corporate governance code in Bangladesh mandates listed enterprises to have at least two independent directors. This requirement is aimed at ensuring corporate governance and accuracy in financial reporting. Independent directors play a crucial role in identifying malpractice and protecting shareholders’ interests.

By having independent directors, companies can maintain transparency and accountability. These directors bring an unbiased perspective to the decision-making process and help prevent conflicts of interest. They also contribute to the development of effective strategies and ensure compliance with regulatory requirements.

Benefits of Independent Directors

Independent directors offer several benefits to listed enterprises. Firstly, they provide an objective viewpoint and bring diverse expertise to the boardroom. Their independence allows them to challenge management decisions and ensure that the interests of all stakeholders are considered.

Furthermore, independent directors enhance the credibility of the company by improving corporate governance practices. They act as a check and balance mechanism, reducing the risk of fraud and unethical behavior. Their presence also instills confidence in investors and helps attract capital.

Challenges and Concerns

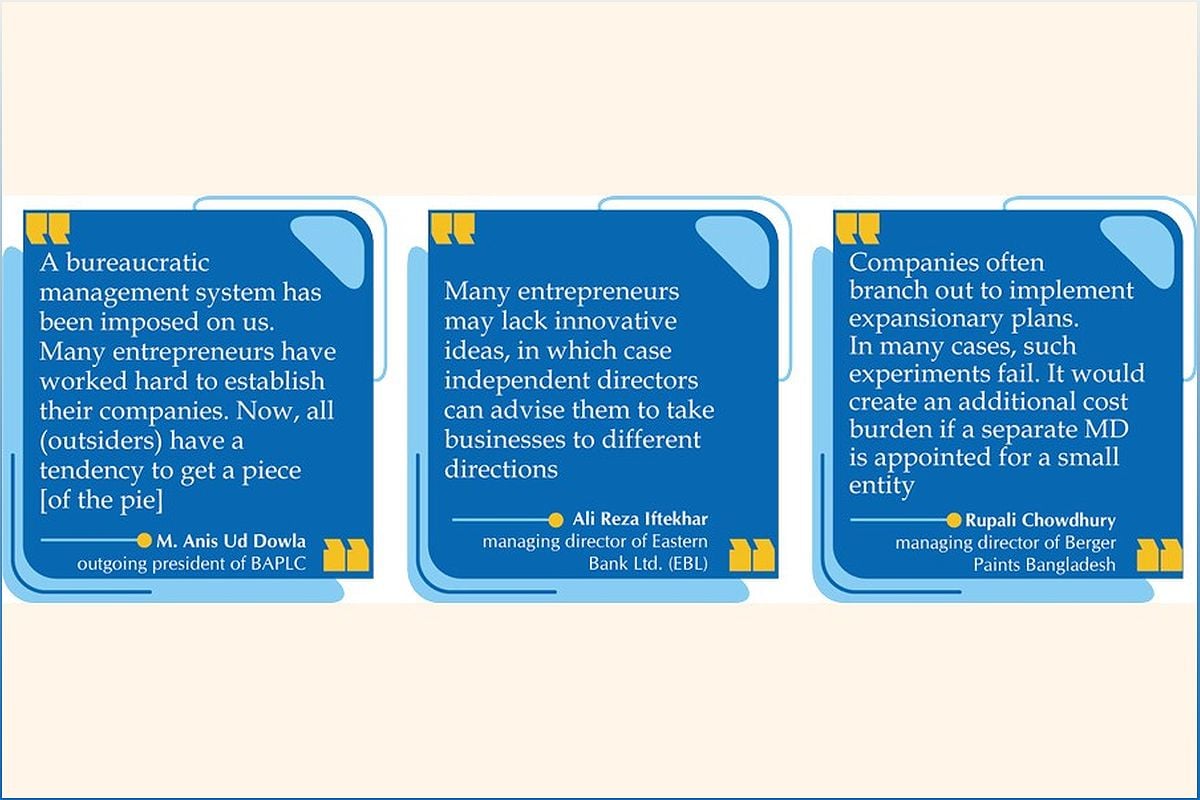

While the amendment to include independent directors is aimed at improving corporate governance, some company owners view it as unwanted intervention in their businesses. They argue that family-oriented businesses may not appreciate the interference of outsiders in their decision-making processes.

Industry associations, such as the Bangladesh Association of Publicly Listed Companies (BAPLC), have expressed concerns about the additional costs incurred by hiring more independent directors. They also highlight the challenges of finding qualified individuals who are willing to take up these positions.

However, it is important to note that the role of independent directors in ensuring transparency and protecting shareholders’ interests cannot be undermined. Striking a balance between the concerns of company owners and the need for good corporate governance is crucial for the sustainable growth of listed enterprises.

The Role of Independent Directors

Independent directors have a wide range of responsibilities in listed enterprises. They participate in board meetings, provide guidance on strategic decisions, and oversee the performance of executive management.

Additionally, independent directors play a crucial role in ensuring accurate financial reporting. They review financial statements, assess internal controls, and identify any potential risks or irregularities. Their expertise and objectivity help maintain the integrity of financial information.

Moreover, independent directors act as a bridge between the company and its stakeholders. They engage with shareholders, address their concerns, and ensure effective communication between the board and the investors.

Compliance with the Amendment

Many listed banks in Bangladesh have already become compliant with the new provision by appointing two or more independent directors. Other companies are in the process of adjusting their board compositions to meet the requirement.

Company secretaries have stated their commitment to complying with the revised provision after obtaining shareholder approvals at the next annual general meetings. This demonstrates the willingness of companies to embrace good corporate governance practices and ensure transparency in their operations.